Russ-o-Meter

Estimates on tax policy questions

from shareholder Russ Sullivan

“RUSS, HOW LIKELY IS IT THAT WE SEE A RECONCILIATION LAW PASSED IN THIS CONGRESS?”

Tax Tidbit

Reconciliation Revival? Ever since Sen. Joe Manchin (D-WV) publicly renounced his support of the House-passed Build Back Better Act (BBBA) in December of last year, the prospects of a reconciliation bill have appeared grim for Democrats. In the wake of this setback, Senate Majority Leader Chuck Schumer (D-NY) has been privately working with Manchin on a revised legislative framework.

To address Manchin’s concerns over rising inflation and congressional spending, any potential agreement will be significantly smaller than the $2 trillion package that passed the House of Representatives last November. The revised package will likely only contain a narrow list of spending priorities, including drug pricing reform, an extension of COVID-era Affordable Care Act (ACA) subsidies, energy outlays and tax incentives. Manchin also continues to insist on the inclusion of significant tax increases to fund equal parts spending and deficit reduction.

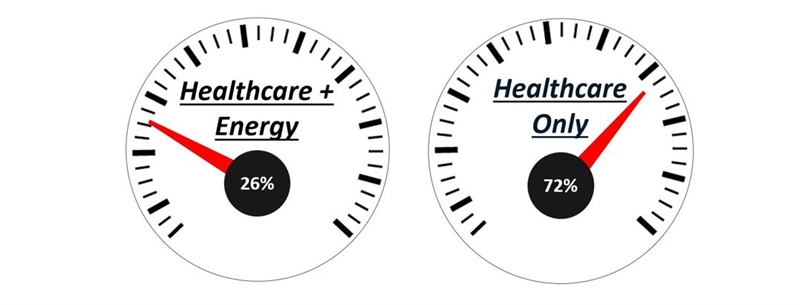

Assuming a package that is broader than just the healthcare provisions, most experts speculate that any prospective agreement would raise no more than $1 trillion in revenue across the coming decade, allocating approximately $500 billion to healthcare and energy spending.

As the revenue target shrinks, several smaller provisions from the House-passed BBBA are expected to be eliminated in the Senate bill. However, the larger revenue raisers, such as changes to the treatment of Global Intangible Low-Taxed Income (GILTI) and Base Erosion and Anti-Abuse Tax, are expected to remain in the bill with a few changes, such as a delay in the effective date (more details below). Similarly, the excise tax on stock buybacks and funding for the Internal Revenue Service (IRS) are also expected to remain in the final bill. Most recently, Democratic staff also noted to the media that the Net Investment Income Tax (NIIT) is also expected to be included in the final bill (more details below). Some form of the Book Profits Minimum Tax is also expected to remain in the bill, though there will likely be changes to address various outstanding issues.

With just four weeks left until the August recess, concrete details on agreed-upon provisions are finally beginning to emerge through public announcements and staff “leaks.” While these stories seem to be building momentum behind reconciliation discussions, some skeptics argue that there might not be enough time to get a deal signed into law. In a normal election year, the practical deadline to get a reconciliation bill on the president’s desk is usually the start of the August recess. However, Manchin’s comments yesterday seemed to indicate that he is comfortable waiting until September 30 to pass the final bill. If the legislative process drags on past the first few weeks of August, politically-vulnerable Democrats will risk losing valuable campaigning time in the build-up to the midterm elections.

Direct negotiations between Manchin and Schumer were mostly paused during the July 4 recess but have since resumed when lawmakers returned to D.C. yesterday. On Monday, the process was further complicated by Schumer’s positive COVID diagnosis. Reports indicate that the senator has a mild case of the illness and will continue to work with Manchin by phone.

Even if an agreement with Manchin is reached within the next few weeks, the process will likely continue until the eleventh hour. The timeline below outlines the steps that would need to occur before an initial agreement on a bill framework could become law.

|

|

|

|

Step 1 – Consensus: Manchin and Schumer will agree on a framework of offsets, spending and deficit reduction. Consultation with Sen. Kyrsten Sinema (D-AZ) will be necessary on revenue provisions. All Democrats must support the bill.

|

|

|

|

|

|

|

|

Step 2 – Drafting New Bill Text: Senate staff of key committees and members will modify the House bill to reflect the Senate deal, complying with the overall scope of the budget directive.

|

|

|

|

|

|

|

|

Step 3 – Scoring the Text: Staff will submit the language to the Joint Committee on Taxation (JCT) and Congressional Budget Office (CBO) to receive new budgetary scores. The new bill and scores will be sent to Republicans to review.

|

|

|

|

|

|

|

|

Step 4 – “Byrd Bath”: Democrats and Republicans will each get one week with the nonpartisan Senate parliamentarian to raise Byrd Rule challenges. If sections of the bill are ruled to be in violation, they are removed.

|

|

|

|

|

|

|

|

Step 5 – Senate Floor: The bill is then put on the Senate Floor. Amendments can be offered for an indefinite period in the “vote-a-rama” process. Republicans will introduce enticing spending amendments to try to derail the process.

|

|

|

|

|

|

|

|

Step 6 – Senate Vote: After amendments that received 51 votes have been incorporated into the bill, the Senate takes a final floor vote. The bill passes the Senate if it receives a vote from every Democrat and the Vice President.

|

|

|

|

|

|

|

|

Step 7 – House Proceedings: The bill will likely not receive any amendments in the House. One or two Democrats may vote against the bill if it does not contain state and local tax (SALT) relief, but it will almost certainly pass.

|

|

|

|

|

|

|

|

Step 8 – Final Passage Into Law: President Biden will sign the modified bill into law as soon as he receives it from the House.

|

|

|

|

Legislative Lowdown

NIIT-Picking Reconciliation. Earlier this week, Democratic staff indicated that an expansion of the NIIT to apply to nonpassive business income would be included in budget reconciliation. The news is primarily attributed to a statement from Sam Runyon, a spokesperson for Manchin, who was quoted as expressing the senator’s support for Medicare solvency. This proposal had previously been included in the House-passed BBBA.

This tax, often referred to as the “unearned income Medicare contribution surtax,” was originally enacted as a revenue-raising provision of the ACA. For applicable taxpayers, the 3.8% surtax applies to the lesser of (i) their total net investment income, or (ii) the amount by which their adjusted gross income (AGI) exceeds $200,000 ($250,000 for joint filers). Net investment income is exclusively composed of any “passive investment income,” such as interest, dividends and capital gains.

The proposed modification to NIIT would expand the 3.8% surtax to apply to nonpassive business income for taxpayers that report an AGI greater than $400,000 ($500,000 for joint filers, trusts and estates). In practice, this would primarily apply to the previously-exempt net passthrough income of partnerships, LLCs, S-corporations and sole proprietorships.

Advocates of the proposal argue that the provision previously awarded an exemption to those with nonpassive income, allowing wealthy individuals to wrongfully claim substantial profits as active business income. They argue that these tax increases will prove essential to protecting Medicare for the coming decade.

Vocal opponents of NIIT expansion have argued that the proposal will significantly raise taxes on thousands of small businesses operating as passthrough entities. These groups claim that the government should not raise taxes on the nearly 52 million Americans employed by a passthrough business.

Last year, the proposal was scored by JCT as raising $252 billion in revenue over 10 years. However, the effective date of the tax will likely be shifted forward by one year because of delays in the reconciliation process, so the provision would raise less revenue. According to reports, it is expected to raise about $203 billion.

While reports have indicated that the likelihood of inclusion of the NIIT expansion in reconciliation has increased, other tax increases on high-income individuals may be dropped. A recent leak from a Capitol Hill aide claims that the proposed 5% surtax on taxpayers with AGI over $10 million and 8% surtax on taxpayers with AGI above $25 million have been “knocked out of consideration.”

The high-income taxpayer surtax proposal may also be modified to include a carveout for passthrough income. This route would ease Sinema’s apprehension towards inadvertently raising taxes on small businesses.

As included in the House-passed BBBA, this proposal would raise $228 billion in revenue over the next decade. With all but assured inclusion of the NIIT expansion, this proposal to further raise taxes on high-income individuals may be seen as duplicative.

Taking Score of Drug Pricing. Last Friday, CBO released official budgetary scores for a proposal to lower the prices that the government pays for prescription drugs provided through Medicare. The reworked section was submitted for scoring last week by Schumer and is estimated to save the federal government approximately $288 billion over the next decade.

The proposal is a modification of a similar set of health provisions that were included in the House-passed BBBA. The proposal raises revenue for the government by allowing the secretary of Health and Human Services to negotiate for lower prices directly with drug producers. Other sections of the proposal would cap out-of-pocket costs for Part D Medicare beneficiaries and increase the value of Medicare rebates to keep pace with inflation.

While official CBO scoring of the proposal is an important step forward for Democrats, most experts already assumed that it would be included in any final deal. Importantly, Manchin supports the drug-pricing language, categorizing it as a direct revenue raiser and not a spending provision.

Now USICA, Now You Don’t. As Congress begins its July work period, lawmakers have yet to reach an agreement on the Bipartisan Innovation Act—also known as the United States Innovation and Competition Act (USICA). The House and Senate are currently engaged in the conference committee process to reconcile the differences between the two chambers’ bills. There is a growing sense in Congress that the package will not be passed before the midterm elections. Negotiators have blown past all of their self-imposed deadlines to reach an agreement and file a conference report. It now seems that the most likely scenario will be a slimmed-down package that would only include the $52 billion CHIPS Act as its centerpiece with perhaps one or two other items. That bill would provide subsidies to aid the domestic semiconductor industry.

However, with renewed reconciliation negotiations underway, Senate Minority Leader Mitch McConnell (R-KY) has suggested Republicans are starting to sour on even a narrow competition bill given the state of play on the reconciliation bill. Just before the Independence Day recess, McConnell tweeted, “Let me be perfectly clear: there will be no bipartisan USICA as long as Democrats are pursuing a partisan reconciliation bill.”

Appropriations Update. The House Appropriations Committee approved all 12 of the FY 23 appropriations bills at the end of June. The House is now scheduled to take up six of those bills next week in a minibus which includes the Agriculture, Energy-Water-Transportation-HUD, Interior-Environment, Financial Services and Military Construction-VA spending measures. Timing for the remaining six bills is yet to be determined. Regardless of what the House ends up passing, the final spending figures will inevitably change as top appropriators in the House and Senate continue to negotiate the topline spending figures. Without an agreement on a topline figure, Congress will have to resort to a continuing resolution to avoid a government shutdown at the end of September.

Global Getdown

Hungary Takes a Bite out of Global Tax Negotiations, Yellen Retaliates. Last week, the Treasury Department announced that the U.S. intends to withdraw from a 43-year-old tax treaty with Hungary after it vetoed the European Union’s version of the 15% global minimum tax in June. With Hungary’s current corporate tax rate remaining at 9%, the foreign minister of Hungary, Peter Szijjarto, stated that regardless of how much international pressure Hungary is facing to approve the global minimum tax, it will not “risk the jobs of tens of thousands of Hungarians.” In response, Treasury Secretary Janet Yellen announced that the U.S. is starting the six-month process to withdraw from the tax treaty because “the benefits are no longer reciprocal.”

While the Biden administration and congressional Democrats broadly support the global minimum tax negotiated last year through the Organisation for Economic Cooperation and Development (OECD), Republican lawmakers have been critical of the agreement and its potential adverse effect on U.S. businesses. In response to Treasury’s action on the Hungarian treaty, Rep. Kevin Brady (R-TX), the House Ways and Means ranking member, and Sens. Mike Crapo (R-TX), ranking member on the Senate Finance Committee, and Jim Risch (R-ID), Senate Foreign Relations Committee ranking member, responded, “Treasury’s latest tactic to force implementation of the OECD agreement is to withdraw from a longstanding bilateral tax treaty approved by Congress.”

Treasury’s treaty action comes on the heels of a letter by a pair of Ways and Means Committee Republicans urging the Hungary government to continue the country’s resistance to the proposed corporate taxation rules. In their June letter to the ambassador of Hungary, Szabolcs Takács, Reps. Adrian Smith (R-NE) and Mike Kelly (R-PA), thanked Hungary’s parliament for its “wisdom in opposing European Union (EU) adoption” of the OECD Pillar One and Pillar Two tax rules. Citing concerns over double taxation and a lack of clarity on how the global minimum tax would implicate the U.S.’s existing global minimum tax regime (known as the GILTI rules), Smith and Kelly indicated that congressional Republicans are unlikely to support measures to implement Pillar One or Pillar Two in the U.S.

The House-passed BBBA includes modifications to the current GILTI rules intended to align the U.S. more closely with the OECD Pillar Two global minimum tax. The fate of those changes remains unclear as negotiations between Schumer and Manchin continue in July over a scaled-down reconciliation bill.

Pillar One Implementation Pushed Further, Not Likely Until at Least 2024. Secretary-General Mathias Cormann of the OECD announced on Monday that Pillar One of the organization’s rewrite of the global tax rules would be delayed until 2024 at the earliest. He commented, “We will keep working as quickly as possible to get this work finalized, but we will also take as much time as necessary to get the rules right.” The statement accompanied an OECD status report on the two-pillar agreement for the G7 finance ministers meeting in Jakarta, Indonesia, this week.

The announcement comes as uncertainty grows in the U.S. as to whether a multilateral agreement implementing Pillar One could be ratified by the Senate in the foreseeable future. Congressional Republicans have repeatedly called on the Treasury Department to engage in closer consultation with Congress and to provide information regarding the effects that the Pillar One profits allocation regime would have on U.S. multinational companies and the U.S. budget. Without U.S. participation, the fate of Pillar One remains unclear.

At a Glance

- Comey Look Into That. Last Thursday, the IRS Commissioner Charles Rettig requested that the Treasury Inspector General for Tax Administration (TIGTA) open an investigation into a pair of tax audits conducted during the Trump administration. The rigorous audits targeted two outspoken critics of the Trump administration, former FBI Director James Comey and former Deputy Director Andrew McCabe. Both the chair and ranking member of the House Ways and Means Committee echoed support for the TIGTA investigation into the statistically improbable auditing of the two men.

Brownstein Bookshelf

- November Dreaming. Politico senior tax reporter Brian Faler outlines five potential tax developments that may emerge from a future Republican-controlled Congress. He speculates that, among other fiscal priorities, Republican legislators may look to shrink the IRS budget, cut capital gains taxes and limit U.S. involvement in international tax treaties.

- The Bare Minimum(s). In her recent article, Thornton Matheson, a senior fellow at Urban-Brookings, discusses the inefficiency of including both a book profits minimum tax and global minimum tax in any potential reconciliation deal. She argues that a combined minimum tax would be simpler to administer, could better align with international tax standards and might prevent a global “race to the bottom.”

- Pandemic Aid Reallocations. Washington Post policy reporter Tony Romm discusses several efforts by state legislatures to use pandemic funding to cut taxes for residents. The federal government has sought to limit this practice, barring states from using their portion of the $350 billion in total aid to subsidize tax revenue. Now, several Republican states are developing creative workarounds, including allocating aid monies to expand their unemployment insurance programs.

Hearings and Events

In Committee

Senate Banking Committee

On Tuesday, the full committee will hold a hearing entitled “Advancing Public Transportation under the Bipartisan Infrastructure Law: Update from the Federal Transit Administration,” during which the following witness will testify:

- Nuria Fernandez (administrator, Federal Transit Administration)

On Thursday, the full committee will hold a hearing entitled “Advancing National Security and Foreign Policy Through Export Controls: Oversight of the Bureau of Industry and Security” during which the following witness will testify:

- Alan Estevez (under secretary for industry and security, Department of Commerce)

House Financial Services Committee

On Wednesday, the full committee will hold a hearing entitled “Better Together: Examining the Unified Proposed Rule to Modernize the Community Reinvestment Act” during which the following witnesses will testify:

- Seema Agnani, executive director, National Coalition for Asian Pacific American Community Development

- Catherine Crosby, chairperson, National Community Reinvestment Coalition

- Yoselin Genao-Estrella, executive director, Neighborhood Housing Services of Queens CDC, Inc.

- Quentin Leighty, CFO and president, First National Bank of Las Animas (on behalf of Independent Community Bankers of America)

- Darryl E. Getter, specialist in financial economics, Congressional Research Service

Senate Finance Committee

On Wednesday, the full committee will hold a nomination hearing for Jay Curtis Shambaugh to be an under secretary of Treasury and for Rebecca Lee Haffajee to be an assistant secretary of Health and Human Services.

House Ways and Means Committee

On Wednesday, the full committee will hold a hearing entitled “Nowhere to Live: Profits, Disinvestment and the American Housing Crisis” during which the following witnesses will testify:

- Dr. Elora Lee Raymond (urban planner and assistant professor in the School of City and Regional Planning in the College of Design at Georgia Tech)

- Dr. Akilah Watkins (president and CEO for the Center for Community Progress)

- Dr. Christopher Herbert (managing director, Joint Center for Housing Studies of Harvard University)

- Audra Hamernik (president and CEO of Nevada HAND in Las Vegas, NV)

- Edward J. Pinto (senior fellow and director of the American Enterprise Institute Housing Center)

Administration

Thursday, July 14

Small Business Administration

Finance: the Foreign Language for Entrepreneurs

Private Sector

Thursday, July 14

Tax Policy Center

The Prescription: Fiscal Policy for Today’s Economy with Barbara Angus