WHAT TO WATCH THIS WEEK

- Republican Counterproposal. Senate Republicans are crafting a counter-proposal as an alternative to President Joe Biden’s American Jobs Plan (AJP). The package is expected to cost around $600 to $800 billion and consist only of “traditional” infrastructure projects like highways, roads and bridges. When exactly the proposal will be introduced is unclear, but its contents will continue to develop this week.

- Hearings. Committees continue holding hearings that could inform the policies ultimately included in the AJP. This week, panels will focus on energy and climate, internet connectivity and rural communities. Find a comprehensive list in the State of Play section below.

LATEST DEVELOPMENTS

- White House Infrastructure Meeting. President Biden continued his push to gain support from lawmakers for his infrastructure proposal. Yesterday, he held the second in a series of meetings on the plan, this time with lawmakers that previously served as state or local government officials. Read more about yesterday’s meeting in the State of Play section below.

- 25% Corporate Tax Rate. Senate Democrats are expected to bring down the 28% corporate rate proposed in the AJP under pressure from moderate Democratic members. In addition to Sen. Joe Manchin (D-WV), who has been outspoken in favor of a 25% rate, Sens. Kyrsten Sinema (D-AZ), Tim Kaine (D-VA), Mark Warner (D-VA) and Jon Tester (D-MT) have expressed concerns over a 28% rate.

- American Families Plan. According to White House aides, the American Families Plan is expected to include about $1 trillion in new spending with about $500 billion in new tax credits. The plan, which is still being finalized, is likely to contain $225 billion for child care, $225 billion for paid family and medical leave, $200 billion for universal prekindergarten, hundreds of billions for education funding and an unspecified amount for nutritional assistance. The plan is also expected to extend the American Rescue Plan Act’s Child Tax Credit expansion through 2025 as opposed to making them permanent, as some members of Congress have pushed.

STATE OF PLAY

Democratic lawmakers are working to translate President Biden’s ambitious $2.3 trillion infrastructure package into legislative language. The president’s American Jobs Plan (AJP) is a New Deal-style proposal that would fund traditional infrastructure priorities, as well as green energy, child care and home-care infrastructure, and low-income housing. It is paid for by the Made in America Tax Plan (MATP)—a series of domestic corporate tax rate hikes designed to make corporations “pay their fair share” and international tax proposals that shore up the U.S. tax base. However, the scope of the proposal and the proposed pay-fors are colliding with the political complexities of passing such sweeping legislation.

Democrats continue to face sharp criticism from both the right and left flanks of the party. Conservative Democrats have raised concerns about raising the corporate tax rate to 28% as some industries have yet to recover from the devastating economic effects of the pandemic. Some Democrats have made their support potentially conditioned on the inclusion of various parochial interests. For example, Democrats from higher-tax states, including New York and New Jersey, are concerned that the proposal does not include relief from the State and Local Tax (SALT) cap imposed by the Tax Cuts and Jobs Act. At the same time, progressives continue to push for more priorities to be added to an already expansive proposal.

Complicating matters is a lack of clarity from the Senate parliamentarian on whether Democrats potentially have another bite at the apple for budget reconciliation. Absent a clear ruling on this issue, lawmakers are unsure how to group existing priorities and proceed.

For now, the administration continues to pursue both budget reconciliation and potentially more bipartisan avenues to pass an infrastructure package. Over the past two weeks, the administration has been meeting with bipartisan groups of lawmakers to discuss various aspects of an infrastructure package. Attending the initial White House infrastructure meeting on April 12 were Sens. Maria Cantwell (D-WA), Alex Padilla (D-CA), Deb Fischer (R-NE) and Roger Wicker (R-MS) and Reps. Donald Payne (D-NJ), David Price (D-NC), Garret Graves (R-LA) and Don Young (R-AK)—members the White House characterized as representatives of key congressional committees responsible for ultimately advancing certain aspects of the infrastructure package.

President Biden hosted a second White House infrastructure meeting yesterday with Sens. John Hickenlooper (D-CO), Jeanne Shaheen (D-NH), Angus King (I-ME), Mitt Romney (R-UT) and John Hoeven (R-ND) and Reps. Charlie Crist (D-FL), Emanuel Cleaver (D-MO), Norma Torres (D-CA), Carlos Gimenez (R-FL) and Kay Granger (R-TX). As members who have all served as former state and local officials, they were able to provide the administration with perspective on implementing infrastructure policies.

Not yet invited to a White House infrastructure meeting is Sen. Chris Coons (D-DE), a moderate Democrat who has been working with members of both parties to find common ground. Last week, Coons suggested Congress break the package in two and pass an initial measure comprised of “traditional infrastructure” along bipartisan lines, followed by one filled with Democratic priorities the party could pass through the budget reconciliation process.

To this end, Republicans plan on offering a counter-proposal of their own consisting of traditional infrastructure costs, totaling between $600 and $800 billion. President Biden has asked Senate Republicans for a counter-proposal by mid-May. Not many details are currently known about the Republican package, which appears to be in the early stages. Republicans are expected to continue developing their proposal over the coming weeks as discussions on infrastructure continue.

Hearings to Watch

|

|

Energy and Climate |

Tax |

Internet Connectivity |

|

Tuesday |

House Energy and Commerce House Natural Resources Senate Appropriations |

Senate Finance |

House Agriculture Senate Banking |

|

Wednesday |

House Transportation and Infrastructure House Science |

House Ways and Means |

House Energy and Commerce House Natural Resources |

|

Thursday |

Senate Banking |

|

|

|

House Education and Labor Honorable Mention |

|||

LEGISLATIVE UPDATES

Tax and Finance Updates

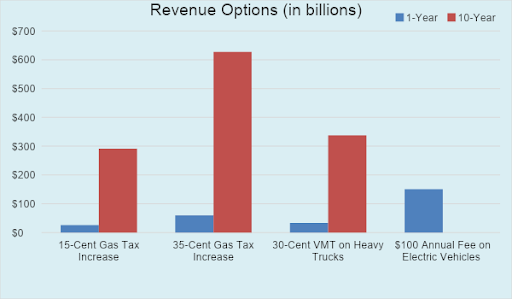

CBO Outlines HTF Funding Options. The Highway Trust Fund (HTF), which provides federal funding for state construction on the interstate highway system, is currently funded by taxes on gasoline and diesel fuel and various levies on heavy trucks—all of which are static and unresponsive to inflation, causing the purchasing power of the HTF to continuously decline. As a result, if no revenue changes are adopted, the HTF is projected to be exhausted next year and run a total shortfall of $195 billion over the next ten years.

To address the looming shortfall, the Congressional Budget Office (CBO) released a report last week in which it outlined the various options to raise revenue for the HTF for lawmakers to consider as they look to pass a comprehensive infrastructure package this year. In general, CBO outlined three potential remedies: increase the existing taxes, impose new taxes or transfer funds to the HTF.

1. Increase Existing Taxes. CBO analyzed two options—increasing the federal excise tax rates on gasoline and diesel fuel by 15 cents and 35 cents per gallon and adjusting both for inflation.

2. Impose New Taxes. CBO considered a vehicle-miles-traveled (VMT) and a $100 annual fee on electric vehicles.

The report also provided additional context on VMTs, saying if a per-mile tax was applied to all commercial trucks on all roads, each additional cent would generate $2.6 billion.

3. Transfer Funds. Finally, CBO weighed the benefits of transferring general revenues to the HTF. It found two advantages: (1) the incremental costs of collection are negligible because income and other taxes are already in place and (2) this approach, compared with other HTF funding options, would not impose a larger burden, relative to income, on lower-income households.

SALT On The Road. The effort to raise or repeal the $10,000 cap on state and local tax (SALT) deductions is gaining steam. Last week, a bipartisan group of House lawmakers launched the Bipartisan SALT Caucus to pressure congressional leadership to raise or repeal the SALT cap in the upcoming infrastructure package. At the time of its launch, the group—led by Co-chairs Reps. Tom Suozzi (D-NY), Josh Gottheimer (D-NJ), Young Kim (R-CA) and Andrew Garbarino (R-NY)—contained 21 Democrats and nine Republicans. That number has since grown to 32 lawmakers, according to Gottheimer.

Among the group’s ranks are several Democratic members of the House Ways and Means Committee, which would be responsible for including any SALT cap changes in the infrastructure package. Ways and Means members on the Bipartisan SALT Caucus include Oversight Subcommittee Chair Bill Pascrell (D-NJ), Social Security Subcommittee Chair John Larson (D-CT) and Worker and Family Support Subcommittee Chair Danny Davis (D-IL) and the following down-dais members:

- Rep. Tom Suozzi (D-NY)

- Rep. Judy Chu (D-CA)

- Rep. Jimmy Panetta (D-CA)

- Rep. Jimmy Gomez (D-CA)

- Rep. Brian Higgins (D-NY)

- Rep. Brad Schneider (D-IL)

In addition to the Bipartisan SALT Caucus, 15 of the 17 House Democrats from New York, including House Democratic Caucus Chair Hakeem Jeffries (D-NY), sent a letter to Speaker Nancy Pelosi (D-CA) and Majority Leader Steny Hoyer (D-MD) last week urging them to fully repeal the SALT cap through the infrastructure package. Similar to other lawmakers outspoken on the issue, the letter says the signatories “will not hesitate to oppose any tax legislation that does not fully restore the SALT deduction.”

The only New York House Democrats to not sign the letter were Reps. Alexandria Ocasio-Cortez (D-NY) and Kathleen Rice (D-NY). Ocasio-Cortez later justified her opposition to the SALT cap repeal, saying it would be a “gift to billionaires” and cautioned House Democrats from withholding their vote for the infrastructure package if it fails to repeal the SALT cap.

According to the Joint Committee on Taxation (JCT), Ocasio-Cortez’s assessment is correct. In a 2019 report, JCT found that 94% of the benefit from repealing the SALT cap would be enjoyed by those earning above $200,000, while less than 6% of the benefit would be seen by those making under $200,000 and only 0.5% would benefit those earning below $100,000.

As discussions on the infrastructure package continue, the pro-SALT repeal camp will have champions in the two most powerful congressional Democrats, both of whom represent high-income states affected by the cap. Pelosi, for example, has said this year she is “sympathetic” to addressing the SALT cap. Her Senate counterpart, Majority Leader Chuck Schumer (D-NY), has already introduced legislation this session, the SALT Deductibility Act (S.85), that would temporarily repeal the SALT deduction cap for tax years 2018 through 2025.

The White House, however, has thus far leaned against repeal. White House Press Secretary Jen Psaki said last week in response to the Bipartisan SALT Caucus that “the president didn’t put it in his proposal,” referring to the AJP, adding that ending the cap “is not a revenue raiser.” According to JCT, repealing the SALT cap would cost $500 billion through 2025 and $100 billion per year beyond that. Psaki did, however, leave the door open to discussion, saying the administration welcomes ideas from lawmakers.

To appease the coalition of members pushing for the SALT repeal, Democratic leadership could put the measure on the floor for a separate vote.

Bipartisan House Sponsors Propose Tax Credits to Kindle Hospitality, Other Industries. As the economy slowly recovers from the effects of the pandemic, certain industries continue to lag behind, particularly the hospitality industry. To address this, a group of 20 Democratic and 15 Republican lawmakers have cosponsored the H.R.1346, Hospitality and Commerce Job Recovery Act of 2021.

The bill offers refundable credits to certain businesses on losses they may have sustained as a result of COVID-19. The bill covers several industries, including trade shows and conventions, restaurants and other businesses that had foods or drinks go unsold as a result of reductions in traffic.

Businesses in the convention and trade show industry, defined to include hotels that host conventions, business meetings or trade shows, would benefit from a refundable credit for (a) 50% of their customers’ qualified participation; and (b) 100% of qualified restart costs. Qualified restart costs include, but are not limited to, renovation, remediation, cleaning and other expenses related to preventing the spread of COVID-19, and any testing of the taxpayers’ employees or guests for COVID-19.

Restaurants benefit from a 100% credit on all qualified restart costs. Qualified restart costs are broadly defined as any costs paid after the bill’s prospective enactment in the course of reopening a restaurant, or in increasing its meal and beverage services if such restaurant was closed or forced to reduce services due to COVID-19.

Lastly, a 90% credit is offered on the eligible taxpayer’s costs of qualified unmerchantable inventory. Qualified unmerchantable inventory is defined as any food or beverage inventory that was manufactured or acquired by the taxpayer and became unmerchantable due to spoilage, expiration, or a change in market conditions which resulted in the lack of a market for such inventory.

The bill is an effort to encourage those businesses hardest hit by the coronavirus pandemic to get back on their feet. It is unclear if the bill has a path forward to inclusion in an infrastructure and jobs package.

Infrastructure Updates

Lawmakers Outline Priorities to Transportation and Infrastructure. Last week, the House Committee on Transportation and Infrastructure held a Members’ Day hearing to consider non-members’ priorities for the forthcoming surface transportation reauthorization. Over 75 members submitted statements for the hearing, which lasted more than six hours. Republicans participated in the event, unlike the Ways and Means Committee’s Members’ Day in March.

Many members focused on projects specific to their districts, such as the Gateway Project, while others expressed support for existing pieces of legislation. Members often offered principles-based remarks, with equity and resiliency being frequent recipients of support. Democrats were quick to call for the inclusion of key components of the Moving Forward Act (H.R. 2) (116), making clear that they intend to apply a broad definition of infrastructure in the next reauthorization. The expansive highway bill passed the House last session absent Republican support and is expected to form the basis of Democrats’ reauthorization proposal.

Green Energy Updates

Treasury Forms Climate Hub. On Monday, Treasury Secretary Janet Yellen announced the creation of a new Climate Hub within the Department, which will be responsible for bringing “to bear the full force of the Treasury Department on domestic and international policymaking, leveraging finance and financial risk mitigation to confront the threat of climate change.”

To lead the new office, Yellen announced John Morton would be the first person to hold the position of Climate Counselor. In this role, Morton will be responsible for advising Yellen on climate concerns to ensure the Department is implementing its climate strategy related to (1) climate transition finance, (2) climate-related economic and tax policy, and (3) climate-related financial risk. According to the announcement, specific focus areas of the office include:

- Mobilizing financial resources for climate-friendly investments at home and abroad, and prioritizing the expedited transition of high-emitting sectors and industries

- Leveraging economic and tax policies to support building climate-resilient infrastructure and ensuring the transition to a net-zero decarbonized economy

- Ensuring that environmental justice considerations feature centrally in programs, policies, and activities given the disproportionate impacts that climate change has on disadvantaged communities

- Ensuring that policies designed and implemented to assist with the transition to a lower-carbon economy are broadly just and equitable and support well-paying jobs

- Promoting globally consistent approaches to climate-related financial risks

Prior to joining the administration, Morton was a partner at Pollination, a specialist climate change advisory and investment firm, and a senior fellow at the HHL Leipzig Graduate School of Management in Leipzig, Germany. Before that, he held multiple positions focused on international policy, including as senior fellows at the European Climate Foundation, the Atlantic Council and Mercator Stiftung.

Morton has prior government experience as well. He served as senior director for energy and climate change in the National Security Council during the Obama administration and in multiple positions at the Development Finance Corporation, ultimately rising to chief operating officer and chief of staff.

After receiving a BA in Russian History and Literature from Harvard College, Morton received an MBA from the University of Pennsylvania Wharton School and an MA in Economics and International Relations from the Johns Hopkins University School of Advanced International Studies.

White House Courts Asia Ahead of Climate Leaders’ Summit. The Biden administration sought to open talks in advance of the Climate Leaders’ Summit to be held on April 22 and 23. Climate Envoy John Kerry met with leaders in Beijing that resulted in a joint affirmation to address climate change “with the seriousness and urgency that it demands.” The joint statement reaffirms the commitments made in the Paris Agreement, which the Biden administration rejoined earlier this year. However, no new commitments have emerged from leaders in advance of the U.S. Summit. It is still unclear what the full extent of participation will be from foreign leadership for this week’s summit.

The intent of the summit is likely to reestablish the U.S.’s negotiating position prior to the United Nations climate change conference (COP26) this November in Glasgow. The U.S. is expected to announce its Nationally Determined Contribution (NDC) during the summit. The White House has yet to officially announce an NDC target, but media reports have anticipated aggressive targets such as 50% below 2005 levels by 2030, and may even announce a specific emission target towards methane. The administration is also expected to make a number of other climate-related policy announcements, including another Executive Order that will likely target the financial and economic impacts of climate change.

Whether the U.S. can successfully reassert itself as a leader on climate by pushing aggressive targets remains to be seen. Difficulties in pushing for emission reduction commitments by emitters in developing countries have long stymied international agreements on climate change and led to the downfall of the Kyoto Protocol. The Paris Agreement was successful in obtaining commitments from developing countries prior to the U.S. withdrawal during the America First era. But, as the U.S. seeks a more aggressive stance, these roadblocks could reemerge on the international stage ahead of the COP26.

Hearings Highlight Debate Over Energy Infrastructure Priorities. On April 15, the House Energy and Commerce (E&C) Subcommittee on Environment and Climate Change and the House Natural Resources Subcommittee on Energy and Mineral Resources held hearings on key energy-related components of the American Jobs Plan. The topics of the hearings covered environmental justice proposals, opportunity zones, and funds needed to plug and reclaim abandoned wells.

The E&C subcommittee hearing was entitled “The CLEAN Future Act and Environmental Justice: Protecting Frontline Communities.” The hearing revealed a partisan divide on issues related to environmental justice (EJ). Democratic members advocated for direct federal funding to underserved communities disproportionately impacted by environmental degradation. Additional policies included bans on federal permitting for certain projects in EJ communities. Republicans countered that these bans were unproductive and impacted job opportunities in these areas. Republican proposals included expansion of Opportunity Zones, which are areas that qualify for tax deferment of capital gains, as an alternative to the EJ proposals.

3. Transfer Funds. Finally, CBO weighed the benefits of transferring general revenues to the HTF. It found two advantages: (1) the incremental costs of collection are negligible because income and other taxes are already in place and (2) this approach, compared with other HTF funding options, would not impose a larger burden, relative to income, on lower-income households.

SALT On The Road. The effort to raise or repeal the $10,000 cap on state and local tax (SALT) deductions is gaining steam. Last week, a bipartisan group of House lawmakers launched the Bipartisan SALT Caucus to pressure congressional leadership to raise or repeal the SALT cap in the upcoming infrastructure package. At the time of its launch, the group—led by Co-chairs Reps. Tom Suozzi (D-NY), Josh Gottheimer (D-NJ), Young Kim (R-CA) and Andrew Garbarino (R-NY)—contained 21 Democrats and nine Republicans. That number has since grown to 32 lawmakers, according to Gottheimer.

Among the group’s ranks are several Democratic members of the House Ways and Means Committee, which would be responsible for including any SALT cap changes in the infrastructure package. Ways and Means members on the Bipartisan SALT Caucus include Oversight Subcommittee Chair Bill Pascrell (D-NJ), Social Security Subcommittee Chair John Larson (D-CT) and Worker and Family Support Subcommittee Chair Danny Davis (D-IL) and the following down-dais members:

-

- Rep. Tom Suozzi (D-NY)

-

- Rep. Judy Chu (D-CA)

-

- Rep. Jimmy Panetta (D-CA)

-

- Rep. Jimmy Gomez (D-CA)

-

- Rep. Brian Higgins (D-NY)

-

- Rep. Brad Schneider (D-IL)

In addition to the Bipartisan SALT Caucus, 15 of the 17 House Democrats from New York, including House Democratic Caucus Chair Hakeem Jeffries (D-NY), sent a letter to Speaker Nancy Pelosi (D-CA) and Majority Leader Steny Hoyer (D-MD) last week urging them to fully repeal the SALT cap through the infrastructure package. Similar to other lawmakers outspoken on the issue, the letter says the signatories “will not hesitate to oppose any tax legislation that does not fully restore the SALT deduction.”

The only New York House Democrats to not sign the letter were Reps. Alexandria Ocasio-Cortez (D-NY) and Kathleen Rice (D-NY). Ocasio-Cortez later justified her opposition to the SALT cap repeal, saying it would be a “gift to billionaires” and cautioned House Democrats from withholding their vote for the infrastructure package if it fails to repeal the SALT cap.

According to the Joint Committee on Taxation (JCT), Ocasio-Cortez’s assessment is correct. In a 2019 report, JCT found that 94% of the benefit from repealing the SALT cap would be enjoyed by those earning above $200,000, while less than 6% of the benefit would be seen by those making under $200,000 and only 0.5% would benefit those earning below $100,000.

As discussions on the infrastructure package continue, the pro-SALT repeal camp will have champions in the two most powerful congressional Democrats, both of whom represent high-income states affected by the cap. Pelosi, for example, has said this year she is “sympathetic” to addressing the SALT cap. Her Senate counterpart, Majority Leader Chuck Schumer (D-NY), has already introduced legislation this session, the SALT Deductibility Act (S.85), that would temporarily repeal the SALT deduction cap for tax years 2018 through 2025.

The White House, however, has thus far leaned against repeal. White House Press Secretary Jen Psaki said last week in response to the Bipartisan SALT Caucus that “the president didn’t put it in his proposal,” referring to the AJP, adding that ending the cap “is not a revenue raiser.” According to JCT, repealing the SALT cap would cost $500 billion through 2025 and $100 billion per year beyond that. Psaki did, however, leave the door open to discussion, saying the administration welcomes ideas from lawmakers.

To appease the coalition of members pushing for the SALT repeal, Democratic leadership could put the measure on the floor for a separate vote.

Bipartisan House Sponsors Propose Tax Credits to Kindle Hospitality, Other Industries. As the economy slowly recovers from the effects of the pandemic, certain industries continue to lag behind, particularly the hospitality industry. To address this, a group of 20 Democratic and 15 Republican lawmakers have cosponsored the H.R.1346, Hospitality and Commerce Job Recovery Act of 2021.

The bill offers refundable credits to certain businesses on losses they may have sustained as a result of COVID-19. The bill covers several industries, including trade shows and conventions, restaurants and other businesses that had foods or drinks go unsold as a result of reductions in traffic.

Businesses in the convention and trade show industry, defined to include hotels that host conventions, business meetings or trade shows, would benefit from a refundable credit for (a) 50% of their customers’ qualified participation; and (b) 100% of qualified restart costs. Qualified restart costs include, but are not limited to, renovation, remediation, cleaning and other expenses related to preventing the spread of COVID-19, and any testing of the taxpayers’ employees or guests for COVID-19.

Restaurants benefit from a 100% credit on all qualified restart costs. Qualified restart costs are broadly defined as any costs paid after the bill’s prospective enactment in the course of reopening a restaurant, or in increasing its meal and beverage services if such restaurant was closed or forced to reduce services due to COVID-19.

Lastly, a 90% credit is offered on the eligible taxpayer’s costs of qualified unmerchantable inventory. Qualified unmerchantable inventory is defined as any food or beverage inventory that was manufactured or acquired by the taxpayer and became unmerchantable due to spoilage, expiration, or a change in market conditions which resulted in the lack of a market for such inventory.

The bill is an effort to encourage those businesses hardest hit by the coronavirus pandemic to get back on their feet. It is unclear if the bill has a path forward to inclusion in an infrastructure and jobs package.

Infrastructure Updates

Lawmakers Outline Priorities to Transportation and Infrastructure. Last week, the House Committee on Transportation and Infrastructure held a Members’ Day hearing to consider non-members’ priorities for the forthcoming surface transportation reauthorization. Over 75 members submitted statements for the hearing, which lasted more than six hours. Republicans participated in the event, unlike the Ways and Means Committee’s Members’ Day in March.

Many members focused on projects specific to their districts, such as the Gateway Project, while others expressed support for existing pieces of legislation. Members often offered principles-based remarks, with equity and resiliency being frequent recipients of support. Democrats were quick to call for the inclusion of key components of the Moving Forward Act (H.R. 2) (116), making clear that they intend to apply a broad definition of infrastructure in the next reauthorization. The expansive highway bill passed the House last session absent Republican support and is expected to form the basis of Democrats’ reauthorization proposal.

Green Energy Updates

General Energy Updates

Treasury Forms Climate Hub. On Monday, Treasury Secretary Janet Yellen announced the creation of a new Climate Hub within the Department, which will be responsible for bringing “to bear the full force of the Treasury Department on domestic and international policymaking, leveraging finance and financial risk mitigation to confront the threat of climate change.”

To lead the new office, Yellen announced John Morton would be the first person to hold the position of Climate Counselor. In this role, Morton will be responsible for advising Yellen on climate concerns to ensure the Department is implementing its climate strategy related to (1) climate transition finance, (2) climate-related economic and tax policy, and (3) climate-related financial risk. According to the announcement, specific focus areas of the office include:

-

- Mobilizing financial resources for climate-friendly investments at home and abroad, and prioritizing the expedited transition of high-emitting sectors and industries

-

- Leveraging economic and tax policies to support building climate-resilient infrastructure and ensuring the transition to a net-zero decarbonized economy

-

- Ensuring that environmental justice considerations feature centrally in programs, policies, and activities given the disproportionate impacts that climate change has on disadvantaged communities

-

- Ensuring that policies designed and implemented to assist with the transition to a lower-carbon economy are broadly just and equitable and support well-paying jobs

-

- Promoting globally consistent approaches to climate-related financial risks

Prior to joining the administration, Morton was a partner at Pollination, a specialist climate change advisory and investment firm, and a senior fellow at the HHL Leipzig Graduate School of Management in Leipzig, Germany. Before that, he held multiple positions focused on international policy, including as senior fellows at the European Climate Foundation, the Atlantic Council and Mercator Stiftung.

Morton has prior government experience as well. He served as senior director for energy and climate change in the National Security Council during the Obama administration and in multiple positions at the Development Finance Corporation, ultimately rising to chief operating officer and chief of staff.

After receiving a BA in Russian History and Literature from Harvard College, Morton received an MBA from the University of Pennsylvania Wharton School and an MA in Economics and International Relations from the Johns Hopkins University School of Advanced International Studies.

White House Courts Asia Ahead of Climate Leaders’ Summit. The Biden administration sought to open talks in advance of the Climate Leaders’ Summit to be held on April 22 and 23. Climate Envoy John Kerry met with leaders in Beijing that resulted in a joint affirmation to address climate change “with the seriousness and urgency that it demands.” The joint statement reaffirms the commitments made in the Paris Agreement, which the Biden administration rejoined earlier this year. However, no new commitments have emerged from leaders in advance of the U.S. Summit. It is still unclear what the full extent of participation will be from foreign leadership for this week’s summit.

The intent of the summit is likely to reestablish the U.S.’s negotiating position prior to the United Nations climate change conference (COP26) this November in Glasgow. The U.S. is expected to announce its Nationally Determined Contribution (NDC) during the summit. The White House has yet to officially announce an NDC target, but media reports have anticipated aggressive targets such as 50% below 2005 levels by 2030, and may even announce a specific emission target towards methane. The administration is also expected to make a number of other climate-related policy announcements, including another Executive Order that will likely target the financial and economic impacts of climate change.

Whether the U.S. can successfully reassert itself as a leader on climate by pushing aggressive targets remains to be seen. Difficulties in pushing for emission reduction commitments by emitters in developing countries have long stymied international agreements on climate change and led to the downfall of the Kyoto Protocol. The Paris Agreement was successful in obtaining commitments from developing countries prior to the U.S. withdrawal during the America First era. But, as the U.S. seeks a more aggressive stance, these roadblocks could reemerge on the international stage ahead of the COP26.

Hearings Highlight Debate Over Energy Infrastructure Priorities. On April 15, the House Energy and Commerce (E&C) Subcommittee on Environment and Climate Change and the House Natural Resources Subcommittee on Energy and Mineral Resources held hearings on key energy-related components of the American Jobs Plan. The topics of the hearings covered environmental justice proposals, opportunity zones, and funds needed to plug and reclaim abandoned wells.

The E&C subcommittee hearing was entitled “The CLEAN Future Act and Environmental Justice: Protecting Frontline Communities.” The hearing revealed a partisan divide on issues related to environmental justice (EJ). Democratic members advocated for direct federal funding to underserved communities disproportionately impacted by environmental degradation. Additional policies included bans on federal permitting for certain projects in EJ communities. Republicans countered that these bans were unproductive and impacted job opportunities in these areas. Republican proposals included expansion of Opportunity Zones, which are areas that qualify for tax deferment of capital gains, as an alternative to the EJ proposals.

Meanwhile, the Energy and Mineral Resources Subcommittee held a hearing entitled “Building Back Better: Creating Jobs and Reducing Pollution by Plugging and Reclaiming Orphaned Wells.” The hearing centered on the Orphaned Well Cleanup and Jobs Act (H.R. 2415), introduced by Rep. Teresa Leger Fernández (D-NM). The bill would amend the Energy Policy Act of 2005 to require the Secretary of the Interior to establish a program to permanently plug, remediate and reclaim orphaned wells and the surrounding lands and to provide funds to states and tribal governments to do the same. Democrats on the committee touted the economic and environmental benefits of the program, highlighting the creation of jobs to replace fossil fuel jobs as a benefit. Republicans on the committee took issue with the bill’s additional bonding and emissions requirements attached to grant funds.

Meanwhile, last week Sens. Ben Ray Lujan (D-NM) and Kevin Cramer (R-ND) introduced bipartisan legislation to clean up orphaned oil and gas wells on federal, state and private lands. The Revive Economic Growth and Reclaim Orphaned Wells (REGROW) Act would provide $4.3 billion in grants to states for orphaned well cleanup on state and private lands. The Department of the Interior would be given $250 million to clean up orphaned wells on public lands and a $150 million grant program would be established within the Bureau of Indian Affairs to assist tribes with orphaned well cleanup. Organizations that have endorsed the legislation include the Environmental Defense Fund, the National Wildlife Federation and the North Dakota Petroleum Council.

Biden Budget Gives Big Bumps to EPA, Interior. This week top officials are set to testify on key energy and environment-related agency budgets. The House Appropriations Subcommittee on Interior, Environment, and Related Agencies will hold hearings on Tuesday and Wednesday to discuss the budgets for the Department of the Interior (DOI) and the Environmental Protection Agency (EPA). Secretary of the Interior Deb Haaland will testify first and is expected to field many questions from Republicans on departmental policies for oil and gas leasing. EPA Administrator Regan will testify the next day and will likely receive questions about the administration’s environmental enforcement priorities and several rulemakings that could address methane and other greenhouse gas emissions. The budget hearing follows the release of topline numbers from the Biden administration in early April.

The Biden administration released its top-level discretionary budget that included huge plus-ups for the EPA and DOI. However, the U.S. Army Corps of Engineers, which partners with the EPA on Clean Water Act permitting programs, saw a 12.9-percent decline in its overall budget request – totaling $6.8 billion. The Corps budget request focused on climate change, infrastructure resilience and water infrastructure projects. The EPA and DOI increases ranked fourth and fifth for the administration—with Education, Commerce and HHS receiving the most substantial requested increases.

The administration is requesting $11.2 billion for EPA, a $2 billion or 21.3% increase from the 2021 enacted level. The plus ups at EPA will focus on shoring up enforcement capacity, $1.8 billion for programs to address greenhouse gas emissions, huge increases in environmental justice programs, $75 million towards addressing per- and polyfluoroalkyl substances (PFAS) pollution, $882 million for the Superfund Remedial program, and $3.6 billion for water infrastructure. The Department of Justice’s Environment and Natural Resources Division would also receive $5 million to tackle environmental justice issues. Prison infrastructure was also included as an environmental justice issue – with $39 million for the Bureau of Prisons to improve conditions of confinement and enhance environmental sustainability of federal prisons.

DOI received an increased request of $17.4 billion, a $2.4 billion or 16-percent increase from the 2021 enacted level. The request would provide for $450 million to address abandoned wells and mines – roughly $15.5 billion shy of the amount the administration hopes to gain in its infrastructure plan. The Interior Department will also focus on honoring its tribal trust obligations, environmental justice initiatives, and funding to address climate-friendly use of public lands and scientific research. The request also asks for $200 million to support the 30 by 30 conservation initiative as well as the Civilian Conservation Corps. Details of the 30 by 30 initiative are still unfolding. Western states will see increased funding towards wildfire management, while specific amounts for the Bureau of Reclamation remain outstanding. The agency also hopes to staff up significantly to accomplish many of the administration’s priorities.

Biden Energy Policy Winds Shift to Offshore. The Biden American Jobs Plan includes a number of tax incentives to support offshore wind. However, the administration is not waiting for Congress to act to support this industry. On March 29, 2021, the Biden administration announced a number of initiatives to support the development of 30 gigawatts of offshore wind by 2030 that do not require congressional action. The initiative spans several agencies and requires significant coordination between National Climate Advisor Gina McCarthy, Interior Secretary Deb Haaland, Energy Secretary Jennifer Granholm, Commerce Secretary Gina Raimondo, and Transportation Secretary Pete Buttigieg. The Biden administration has framed its initiative on offshore wind under three categories – the advancement of new offshore wind projects with a focus on job creation, improving the supply chain and deployment of offshore wind, and increased research and development (R&D) and data sharing for more advancements in offshore wind.

The Biden administration announced a new priority Wind Energy Area in the New York Bight. The initiative directs the Bureau of Ocean Energy Management (BOEM) to announce a new priority area for offshore wind in shallow waters between Long Island and the New Jersey coast. According to the Biden fact sheet, the area could support “25,000 development and construction jobs from 2022 to 2030, as well as an additional 7,000 jobs in communities supported by this development. [And also] support up to 4,000 operations and maintenance jobs annually, and approximately 2,000 community jobs, in the years following.” This new area would increase the number of BOEM leases available. BOEM has 16 active commercial wind energy leases off the Atlantic coast at this time. In order to carry out this initiative, BOEM will need to publish a Proposed Sale Notice, followed by a formal public comment period and a lease sale in late 2021 or early 2022.

The Departments of Interior (DOI), Energy (DOE), and Commerce (DOC) announced a shared goal to deploy 30 gigawatts (GW) of offshore wind in the United States by 2030. BOEM estimates that this will create nearly 80,000 jobs. The administration stated, “this target will trigger more than $12 billion per year in capital investment in projects on both U.S. coasts, create tens of thousands of good-paying, union jobs, with more than 44,000 workers employed in offshore wind by 2030 and nearly 33,000 additional jobs in communities supported by offshore wind activity.” The administration also made sure to highlight the supply chain and environmental benefits as a result of the 30 Gigawatts by 2030 goal. The administration also committed the Interior Department to advancing new lease sales and completing the review of at least 16 Construction and Operations Plans (COPs) by 2025.

The Biden administration announced that $230 million would be made available through the U.S. Department of Transportation’s (DOT) Maritime Administration. The funding would be administered as grants and direct the agency to “consider how proposed projects can most effectively address climate change and environmental justice imperatives.” This initiative could assist offshore wind operators with storage areas, laydown areas, and docking of wind energy vessels to load and move items to their operations. Additionally, the DOE Loan Programs Office (LPO) will be leveraged to facilitate access for the offshore wind industry for up to $3 billion in debt capital support through LPO’s Title XVII Innovative Energy Loan Guarantee Program.

With regard to R&D, the administration announced that it had awarded $8 million to 15 offshore wind research and development projects that were selected through a competitive process. The awards were issued by the National Offshore Wind Research and Development Consortium (NOWRDC), which has issued $47 million to date. The administration also announced $1 million in grants to be issued by NOAA’s Northeast Sea Grant programs, in partnership with DOE, DOC, and NOAA’s Northeast Fisheries Science Center. The goal of the research grants would be to “further understanding of the effects of offshore renewable energy on the ocean and local communities and economies as well as opportunities to optimize ocean co-use.”

Energy Tax Updates

House Republicans Introduce Climate Action Package. On April 16, House Agriculture Committee Republicans introduced a package of legislation to address climate change through agricultural incentives, aiming to offer alternatives to expected Democratic proposals for addressing climate change.

The lawmakers sponsoring the package hope to gain bipartisan support for their proposals. “We are not debating whether or not climate change is real; those days are over,” stated House Agriculture ranking member G.T. Thompson (R-PA). “The debate is simply how to best address climate change, and I am confident innovative, science-based, natural solutions with producers at the helm is the path forward.”

The package includes proposals to:

-

- create incentives for private-public partnerships by allowing businesses to invest in conservation practices in geographic regions of their choice and allow the USDA to provide matching funds;

-

- provide forest management generally, as well as near roadways and of private timber sales;

-

- provide incentives for states to individually come up with action plans for improving soil health; and

-

- increase cost share and practice payments under existing federal programs to incentivize the purchase of precision agriculture technology.

Granholm Comments on Battery Storage. This past week, Energy Secretary Jennifer Granholm pitched the Biden infrastructure plan to various groups and coalitions. Granholm highlighted the administration’s support of tax credits for battery technology, noting that several credit models could work. “The bottom line is, I think, whether it’s tax credits, whether it’s refundable tax credits, tax credits that can be monetized upfront and/or over the period of time…The American Jobs Plan has laid out a framework of what things should look like…”

The recently proposed American Jobs Plan includes a 10-year extension and phase-down of a direct-pay investment tax credit and production tax credit for clean energy generation and storage. Currently, energy storage technologies can only take advantage of the tax credit when they are integrated with other eligible renewables.

BUILD BACK BETTER PROPOSALS AT A GLANCE

Over the course of the next few months, members will introduce several pieces of legislation, with the hopes that their proposals will be considered for inclusion in the next package. While significant developments are discussed in the legislative updates section, click here for a running list of other relevant legislation introduced this week.

ACTIVITY THIS WEEK

Click here to view congressional activity for the week.

For additional information or assistance with a particular issue, please contact a member of the Brownstein Tax Policy Group.

This document is intended to provide you with general information regarding congressional updates related to federal infrastructure plans. The contents of this document are not intended to provide specific legal advice. If you have any questions about the contents of this document or if you need legal advice as to an issue, please contact the attorneys listed or your regular Brownstein Hyatt Farber Schreck, LLP attorney. This communication may be considered advertising in some jurisdictions.

You have chosen to send an email to Brownstein Hyatt Farber Schreck or one of its lawyers. The sending and receipt of this email and the information in it does not in itself create and attorney-client relationship between us.

If you are not already a client, you should not provide us with information that you wish to have treated as privileged or confidential without first speaking to one of our lawyers.

If you provide information before we confirm that you are a client and that we are willing and able to represent you, we may not be required to treat that information as privileged, confidential, or protected information, and we may be able to represent a party adverse to you and even to use the information you submit to us against you.

I have read this and want to send an email.